(This is the Warren Buffett Watch newsletter, news and analysis on all things Warren Buffett and Berkshire Hathaway. You can...

admin

Elon Business Fellow Emilie Orendorff ’26 is empowering women in the male-dominated finance field through mentorship, confidence and leadership as...

Amay Tewari Despite having a multibillion-dollar endowment, Yale is enduring budget cuts and financial tightening this year in response to...

Top headlines of the week, Oct. 10 2025Here are some stories you may have missed this week in central Ohio.A...

Gold (GC=F) futures opened at $4,114.80 per ounce on Thursday, up 1.7% from Wednesday’s close of $4,044.40. The price of...

About this role: Wells Fargo is seeking a Lead Finance Analyst, reporting to a Finance leader for the Chief Data...

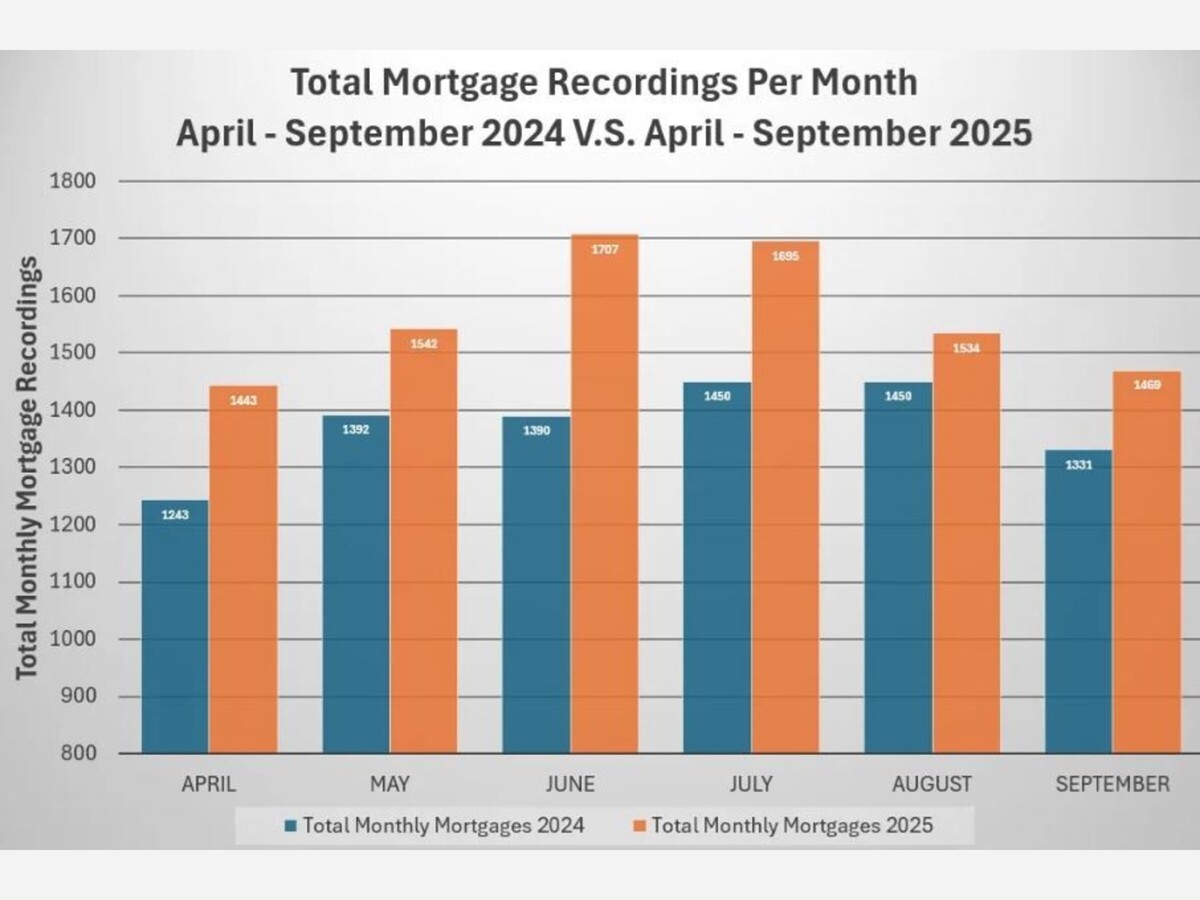

Norfolk County Register of Deeds William P. O’Donnell reported that real estate activity in Norfolk County continued its upward trend...

The investment outlook over the course of 2025 has, in many cases, been quite striking. According to data from the...

Are you suffering from decision fatigue? Do you have better things to do than oversee a complex portfolio and keep...

ERIE, CO – October 16, 2025 – PRESSADVANTAGE – Apex Money Lending Group LLC announced today that recent tax incentive...