Top headlines of the week, Oct. 10 2025Here are some stories you may have missed this week in central Ohio.A...

investment

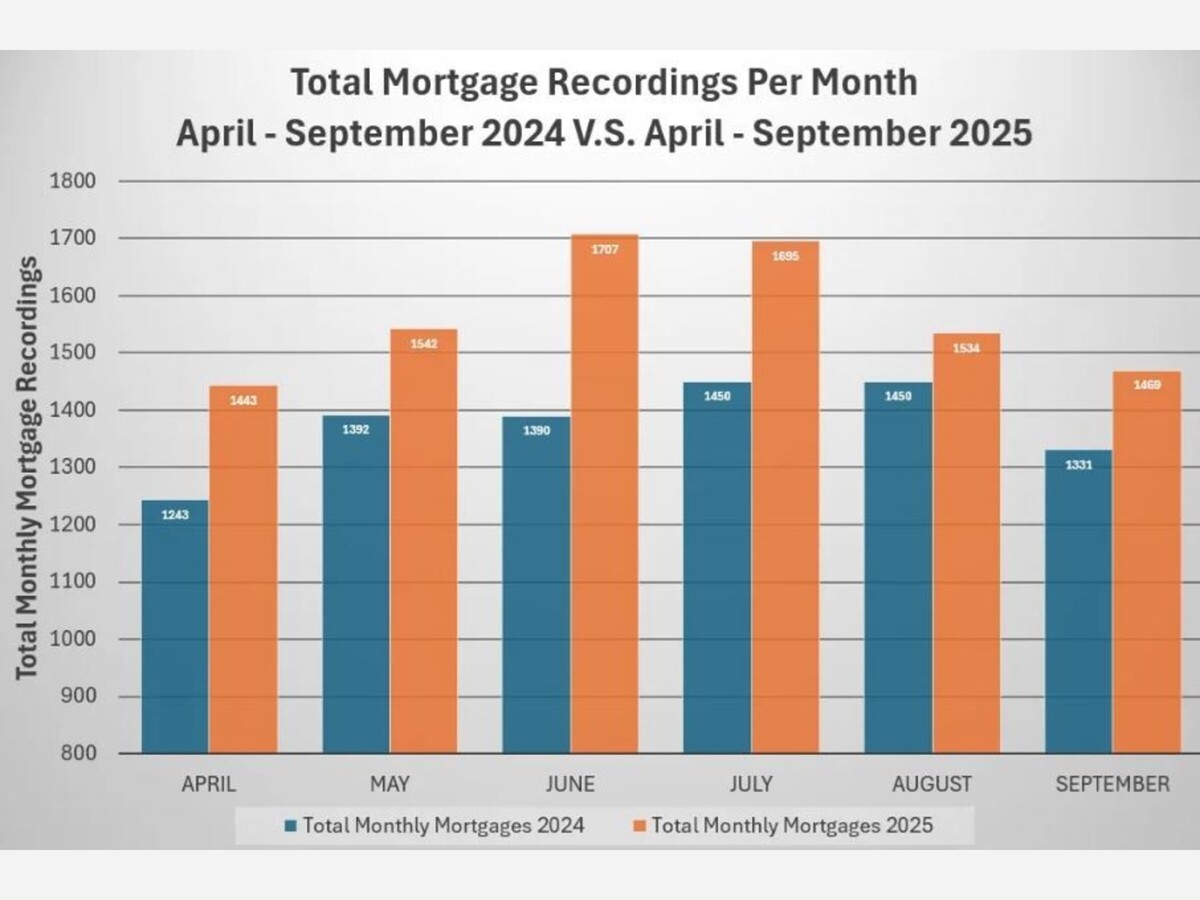

Norfolk County Register of Deeds William P. O’Donnell reported that real estate activity in Norfolk County continued its upward trend...

The investment outlook over the course of 2025 has, in many cases, been quite striking. According to data from the...

ERIE, CO – October 16, 2025 – PRESSADVANTAGE – Apex Money Lending Group LLC announced today that recent tax incentive...

ERIE, CO – October 16, 2025 – PRESSADVANTAGE – Apex Money Lending Group LLC announced today that recent tax incentive...

Born Defense is emerging from stealth to support organizations engaged in the cyber ‘Forever War’, but from within the constraints...

Ionic Rare Earths Limited (“IonicRE” or the “Company”) (ASX: IXR) has received a vote of confidence in its global expansion...

Email Sign Up For Our Free Weekly Newsletter According to property consultant Avison Young, Warsaw -- Poland's prime real estate...

WINTER PARK, Fla., Oct. 15, 2025 (GLOBE NEWSWIRE) -- Alpine Income Property Trust, Inc. (NYSE: PINE) (the “Company”), a publicly...

Investment to support growth initiatives, including near-term add-on acquisitions CHICAGO, Oct. 14, 2025 /PRNewswire/ -- GTCR, a leading private equity...