Millennial investors lead surge in buy-to-let property market

Millennial investors will account for half of the new buy-to-let limited companies to be set up this year — the first time this generation has ever reached this threshold — as older landlords cool on property investment.

People born between 1981 and 1996 will make up 50 per cent of the total in England and Wales who invest in companies in 2025, a study of Companies House data by Hamptons, the estate agency, found.

Its data, which provides a whole-year projection based on current investment levels, finds that 33,395 companies in total will be set up by this generation in 2025 — a 142 per cent rise on the number incorporated in 2020.

In addition, the research found that 75 per cent of shareholders in new companies will be under the age of 50 this year, up from 68 per cent a decade ago.

By contrast, older generations are cooling on setting up buy-to-let companies, with baby boomer investors, born between 1946 and 1964, dipping from 4,919 new firms in 2024 to 4,425 today — 7 per cent of the total, down from 8 per cent.

Meanwhile, middle-aged Generation X investors, born between 1965 and 1980, were also flat, dipping from 35 per cent down to 33 per cent.

While landlord investment overall has been made less attractive in recent years due to rising taxes dating back to George Osborne’s time as chancellor in 2016, holding properties in a company structure can offer significant tax advantages and so remains popular.

Advantages include being able to deduct your mortgage interest from rental income when working out your taxable profit — a benefit that used to be available to all landlords before April 2017 before being phased out.

Those who own buy-to-lets in a company structure can deduct 100 per cent of their borrowing costs, so their tax bill is based on their profit, rather than turnover. They can also offset other expenses, such as the cost of replacement fixtures, against tax.

• Record number of landlords go professional to beat tax changes

Aneisha Beveridge, head of research at Hamptons, says: “What’s striking is the rise of younger landlords. Millennials, many of whom have struggled to buy their own home, are now leading the charge in buy-to-let.”

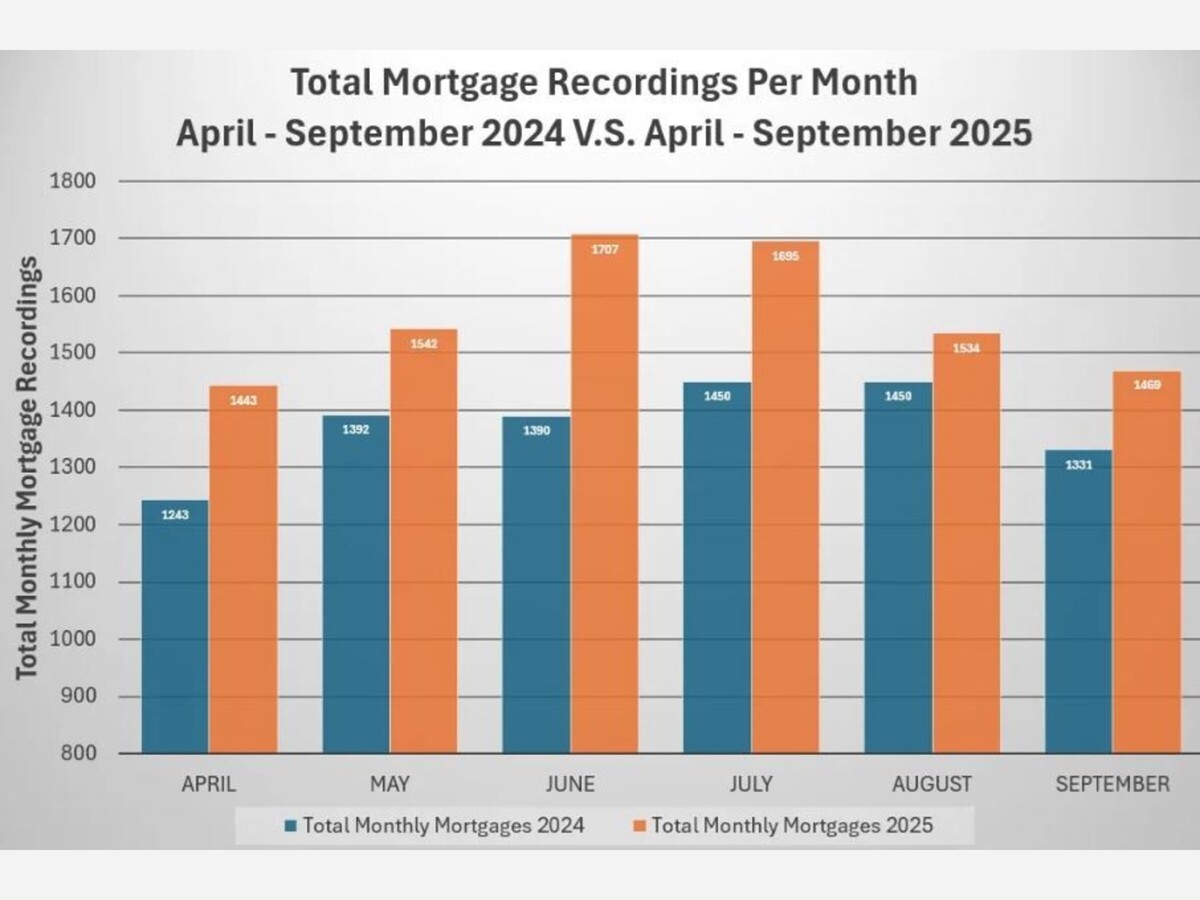

Separate Hamptons figures examining all landlord purchases — both in and out of company structures — found overall landlord numbers subdued.

This research, which used the agency Connells’ database, found that buy-to-let purchases made up 11.3 per cent of all transactions in the third quarter of this year, down from 15.1 per cent when landlord investment was at its peak in 2015.

Landlords who are continuing to invest are increasingly doing so in more affordable areas which might provide a better yield. The regions of London, the southeast, southwest and east of England combined accounted for 34 per cent of investor purchases across England and Wales in the third quarter of this year — down from 50 per cent in 2016. By contrast, the northeast alone made up 28.4 per cent of purchases — more than triple the London total of 8 per cent.

• Should I sell my rental property to the long-term tenants?

“Landlord purchases haven’t collapsed in the face of higher taxes and tighter regulation — but they have shifted,” says Beveridge.

“New landlords have increasingly become an endangered species in markets across southern England, where big stamp duty bills and flatlining prices have nudged investors northwards.

“But in places like the northeast, landlord activity remains close to all-time highs, showing that the buy-to-let market is adapting rather than retreating.”

link